In England, a window tax was introduced in 1697 during the reign of William and Mary. One of their first acts on assuming the throne had been to abolish the hated hearth tax that had been imposed in 1662. However, England faced continual financial difficulties during their reign, caused for example by the war with France. To defray these costs, a tax was imposed in 1696 in the form of a tax on windows.

The tax was designed to be proportional to the prosperity of the taxpayer. Since glass was very expensive and hard to make, the theory was that the number of windows in a house would vary according to the wealth of the owner. The house tax was thought to be a less controversial way of generating income for the government than the new concept being considered - income taxes! At that time, many people in Britain opposed income tax, on principle, because they believed that the disclosure of personal income represented an unacceptable government intrusion into private matters, and a potential threat to personal liberty. (The first British Income tax was introduced in the late 18th century and since then it has been widely popular with citizens worldwide who pay it willingly and without any fear of government misuse.)

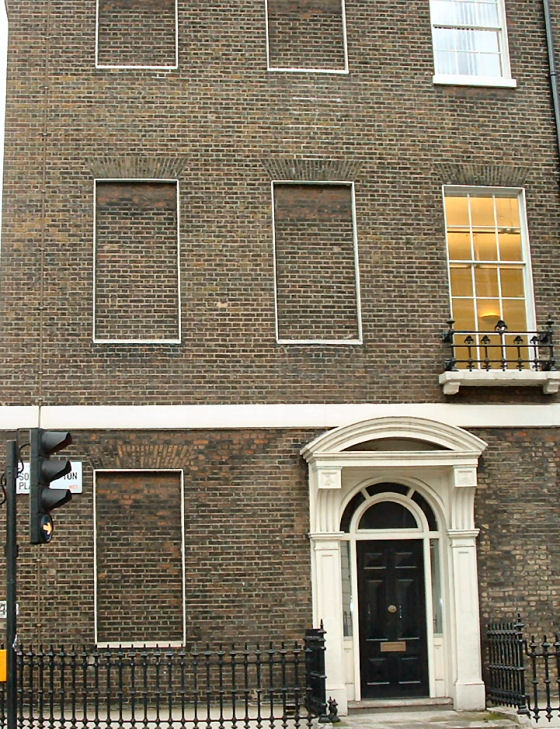

Window taxes were scaled according to the number of windows in the house. Initially, 2 shillings per year was assessed against every house with less than 10 windows. The tax increased incrementally for each window after the ten. The tax was increased no fewer than six times between 1747 and 1808, according to how needy the government was (for example, to fight the American War of Independence). (A window tax was introduced into Scotland in the 1780s.) The tax could be applied very stringently; for example, gratings into coal cellars were taxed as windows. This lead to residents blocking up windows to avoid paying taxes. (See picture above.)

In some parts of the country, the exact opposite reaction took place. Some families would commission a home whose architecture would make the maximum possible use of windows. In extreme cases, they would have windows built over structural walls. This exercise in ostentation was intended to separate the very rich from the rich.

In 1823, the tax was abolished for houses with seven or fewer windows. This led to some houses being built with exactly seven windows. There was a strong agitation in favour of the abolition of the tax during the winter of 1850-1851, and it was accordingly repealed on the 24th of July 1851, and a tax on inhabited houses substituted. (I bet the agitators never saw that coming!)

If it wasn’t for tax purposes, why then was this information on number of windows collected on the 1861 and later census returns? Further research revealed that this data was collected only in Scotland. A ploy by the British government to learn where the biggest Scottish houses with the most windows existed so that they could assign marauding bands of soccer fans to specific targets? No – nothing quite so draconian, I’m afraid. After 1855, Scotland had its own census authority and they collected the information so that they could track the social, living conditions of the population. (The 1861-1881 censuses also collected the number of children between the ages of 5 and 15 who were attending school or being educated at home.) For us genealogy buffs, however, the information gives us a sliver of information on how our ancestors lived.

Sources

Census Guide for England and Wales http://www.genclub.co.uk/resources/UK+Census+guide.htm

On the Level: Building Tax http://www.telegraph.co.uk/property/main.jhtml?xml=/property/2002/07/31/plevel28.xml

Researching the History of Houses: http://www.buildinghistory.org/Buildings/Houses.htm

Wikipedia: Window Tax: http://en.wikipedia.org/wiki/Window_tax

Window Tax: http://www.1911encyclopedia.org/Window_Tax

Window Taxes and Highway Robbery: http://www.bbc.co.uk/radio4/history/sceptred_isle/page/120.shtml?question=120